What Is Cashless Health Insurance?

In the rapid lifestyle of the current times, cashless health insurance is a convenient option in which policyholders do not have to pay bills for medical services upfront.

You simply need to produce your insurance card at the counter of the hospital, and the insurer reimburses the insured amounts directly.

Example:

You are getting treated in an integrated hospital — rather than being required to pay cash upfront, you just swipe your credit card and get the treatment.

What Is Reimbursement Health Insurance?

The policyholders of reimbursement health insurance pay healthcare treatment costs out of pocket.

You submit a claim and present evidences to the insurer for reimbursement as per your policy.

Example:

You pay Rp 10 million towards hospitalization, then pretend to recover the amount eligible.

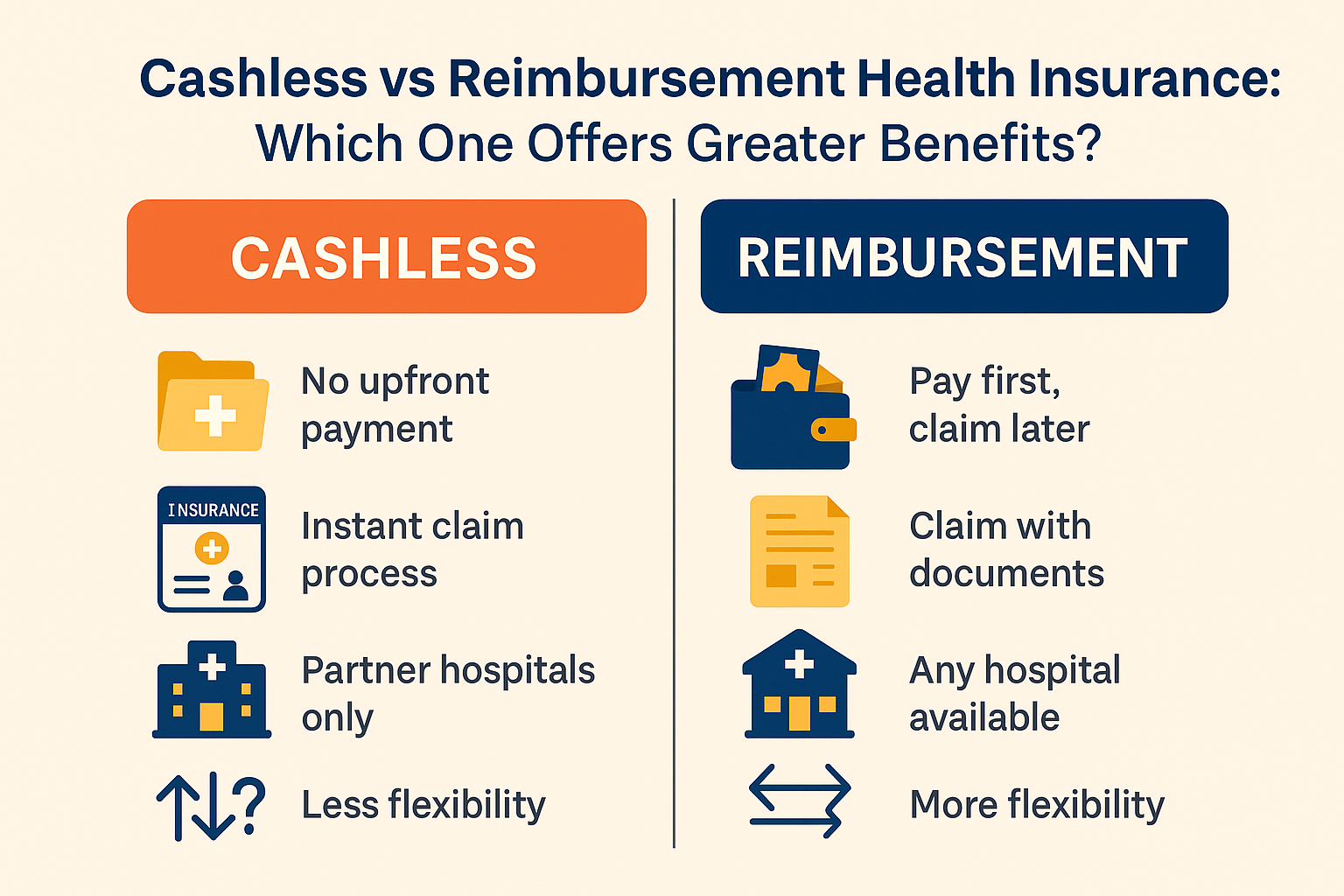

Cashless vs Reimbursement: A Comparative Analysis

For simplicity, the following is a side by side comparison:

Advantages and Disadvantages of Cashless Systems

✅ Pros:

Instant treatment without the financial burden.

Easy hospital admission procedures.

Less administrative hassle for patients.

❌ Cons:

Restricted only to the insurer’s partner hospitals.

Outside the network, reimbursement exists.

Advantages and Limitations of Reimbursement Systems

✅ Benefits:

Independence to see any healthcare provider, like non-network hospitals.

More room for flexibility in specialist treatment.

❌ Drawbacks:

Must pay upfront, which impacts individual cash flow.

Overburdening claim processing with stringent documentation.

Cashless insurance is ideal for individuals who:

- Appreciate convenience and easy access to a hospital.

- Do not desire to go through lengthy administrative procedures.

- Have recurring interactions with the insurer’s networked healthcare.

Reimbursement insurance is ideal for those who:

- Desire flexibility in choosing medical care providers.

- See doctors or hospitalize themselves on a regular basis at hospitals or physicians outside the insurer’s network.

- Are not hassled with processing claims and writing out-of-pocket payments.

Finally, the best one depends on your own personal health care needs, lifestyle, and planning.

Suggestions on Selecting Suitable Health Insurance

Before purchasing the policy, always remember:

- Hospital Network Coverage: Simple with big ones.

- Annual Benefits and Limits: Provide adequate protection for costly care.

- Claim Facility: Clarity and quickness are extremely significant.

- Company’s Reputation: Opt for well-established insurance companies with sound claim settlement record.

Reimbursement and cashless health insurance, both have their benefits.

Cashless is your option if you prefer hassle-free, instant hospitalization.

But reimbursement insurance will suit you better if you appreciate choice and freedom to visit any healthcare provider.

Tip:

Never purchase a health insurance policy without comparing at least a few of them. Read the terms carefully, and see if the policy suits your healthcare requirements and expenditure.