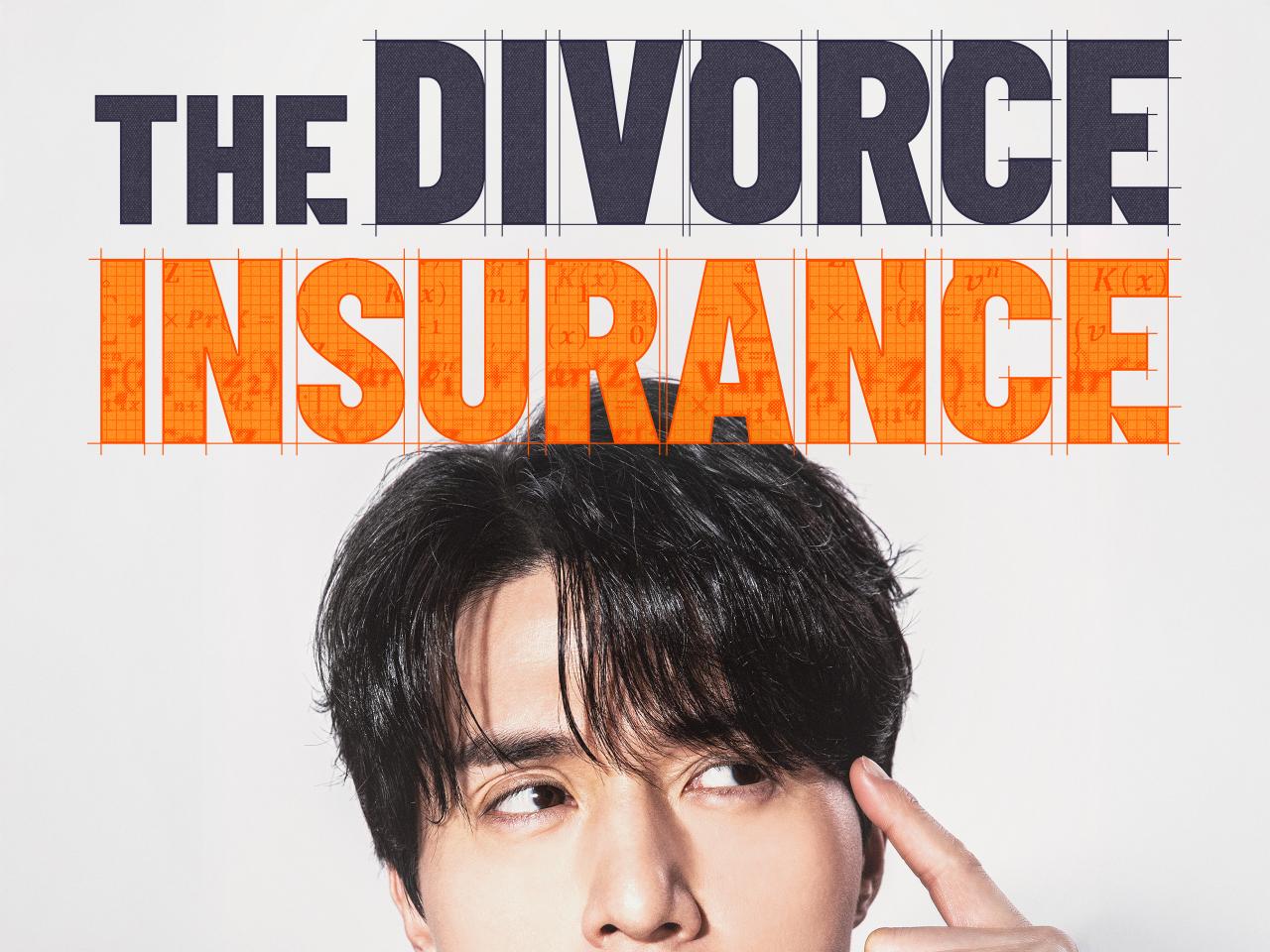

The Divorce Insurance is one of the Korean dramas that has taught its audience about the originality of its plot, i.e., divorce insurance. Not only is it interesting, but it also provokes serious discussion on economic security from marriage. Is divorce insurance feasible in real life? This article gives an overview of the drama summary, addresses the issue of divorce insurance, and sets the degree of reclassification in real life.

1. An Insight into “The Divorce Insurance”

The play follows the life of Noh Ki-jun, a veteran actuary at Plus General Insurance, whose three marriages have ended in divorce. He creates a new product: divorce insurance. The policy will pay back legal costs and asset division charges if the couple divorces within a specific time frame. Even though the product is innovative, controversy and ethical issues arise in society. The play follows moral issues about and the subtlety of marriage in today’s society along the way.

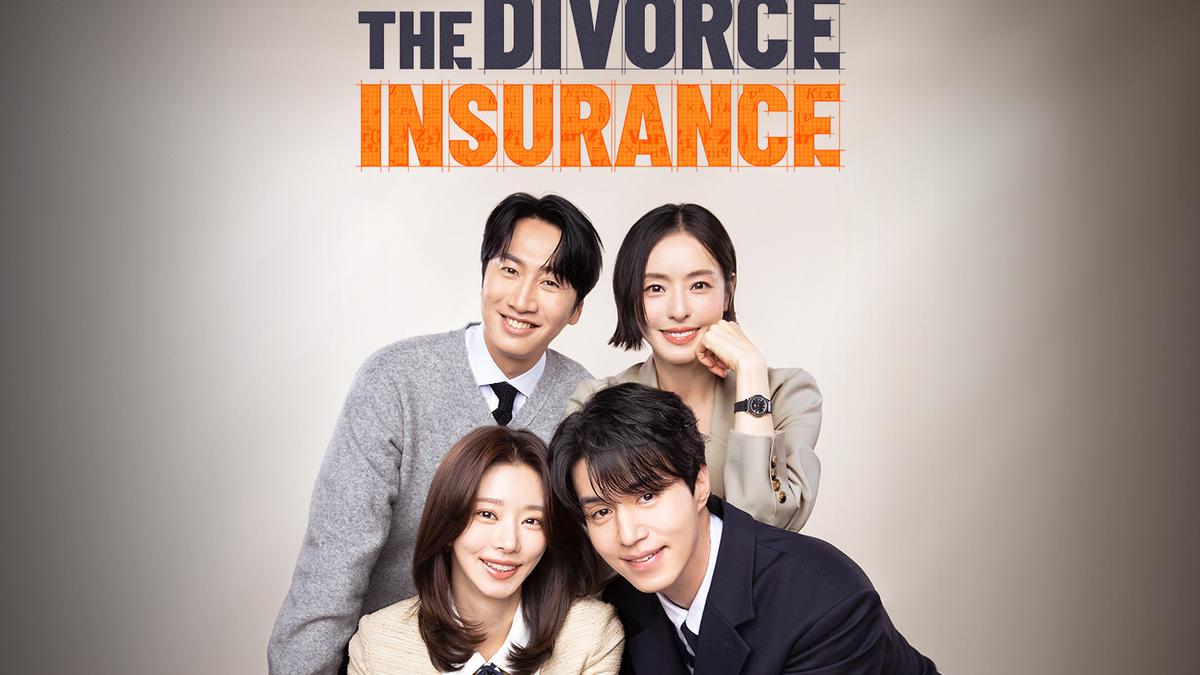

Leading Cast:

Kang Ji-sub as Noh Ki-jun, the practical actuary who designs the unpopular product.

Lee Da-in as Han Jae-mi, a tough lawyer and Noh Ki-jun’s love interest, beleaguered by the ethics of divorce insurance.

Kim Hye-sun as Choi Jung-ran, a veteran insurance director who must deal with corporate interests and social conscience.

2. The Divorce Insurance Idea in the Drama

Divorce insurance in the television show is an economic protection for such couples that would be divorced and abandoned. Everything in terms of legal costs, splitting the property, and damages is covered by the insurance. Although hypothetical in a television show, the concept shows how far married couples require an economic protection before the failure of marriages.

3. Divorce Insurance in Real Life

Although divorce insurance is not common, there are certain services that substitute for it. For instance, in Japan, there are firms that offer “divorce services” which include legal advice and administrative services. There are also prenuptials and legal expenses insurance that act as alternatives to protecting personal rights and property during marriage.

4. The Significance of Divorce Insurance

Divorce also has its economic drawbacks. Legal costs, distribution of assets, and spousal maintenance can be economically stressful. Careful financial planning, i.e., legal and financial security, appears to gain further significance these days during marriage.

5. Becoming Financially Secure During Marriage

Avoid finance problems when divorcing by embracing the following concepts:

- Prenuptial Agreements: Court agreement regarding the division of assets and maintenance during marriage at the time of divorce.

- Legal cost insurance: Insurance for consultancy charges and advocacy charges while undergoing the divorce process.

- Joint Financial Planning: Discussion of money, saving, investment, and spending to encourage honesty and readiness for any unforeseen circumstances.

Moral Lessons from the Drama

Aside from its theme of money, The Divorce Insurance also has some other, deeper lessons to impart about relationships and personal growth. It shows the importance of:

- Communication: Speaking is what makes each other trust one another in marriage.

- Understanding: Having knowledge that effort entails commitment and love, especially during difficult times.

- Preparedness: Financial as well as emotional preparedness may make adjustment between marital failures easier.

- Empathy: Beyond policy and contract, an understanding of human feelings from which all conclusions have been drawn.

The Divorce Insurance soap opera also requires earnest consideration in financial protection during marriage. Similar to real divorce insurance, it is not common; the mere notion is astounding, consistent with the importance of ample financial planning and legal expertise within the institution of marriage. Preventive measures by couples can have a solid base to be capable of withstanding financial catastrophes, e.g., prospective divorce.